Save with Community Solar

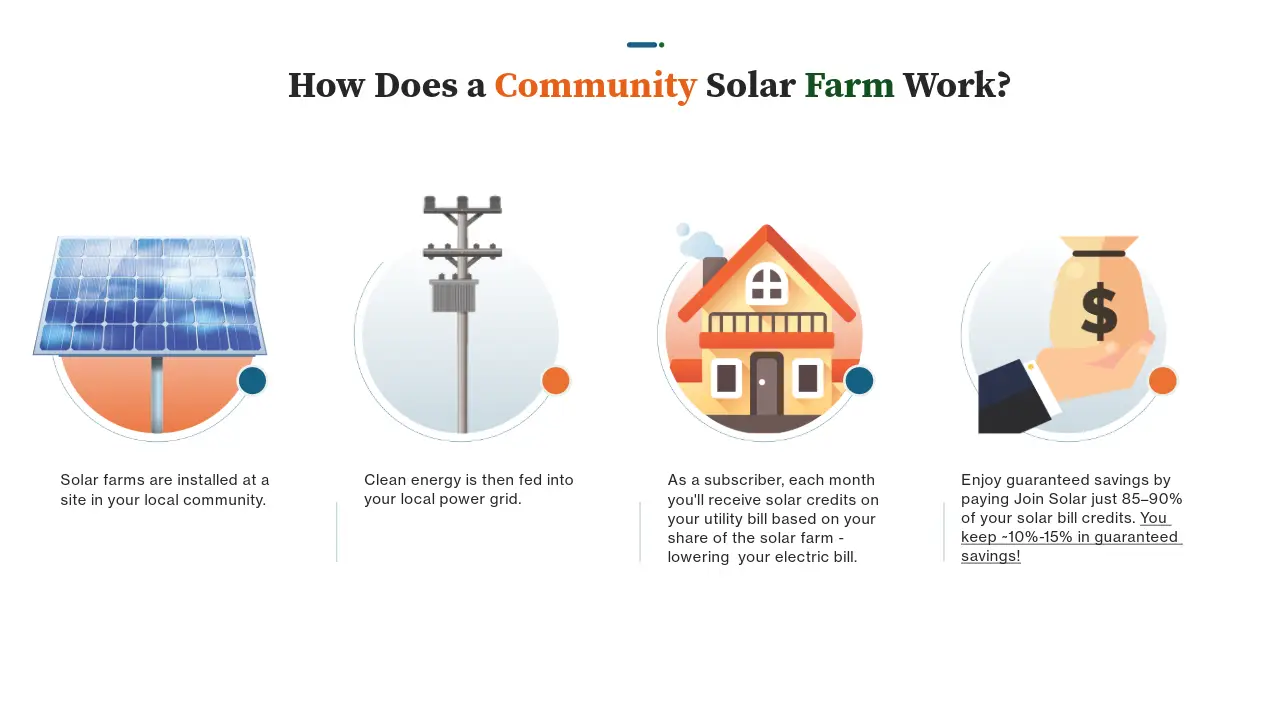

How Community Solar Works for You

Community solar works a lot like a community garden. Local utility customers sign up for subscriptions to a central solar facility—known as a community solar garden—and receive credit on their utility bills for energy produced.

How Much Can You Save? It Depends on Your Utility!

Community Solar programs vary by state; savings depend on local incentives and utility policies. Most Join Solar members save around 10% to 15% on annual energy costs, but the exact amount and billing process may differ based on your utility provider and rate class.

Save money

When you join a community solar garden, the energy produced goes toward your electric bill. How much you save depends on how much energy the solar garden produces. Most members save 10% annually on their electricity bills.

Support clean, local energy

By joining a community solar garden, you’re saying yes to renewable energy in your neighborhood.

Combat climate change

Community solar gardens reduce demand for fossil fuels, limit greenhouse gas emissions, and shrink our collective carbon footprint.

Explore Our Solar Gardens

Ready to go solar? Below is a list of community-powered solar gardens currently being built. Membership is limited so apply soon.

Join Bangor Hydro Community Solar for up to 15% savings

Join Bangor Hydro Community Solar Save ~15% On Your Electricity Bill! Are you a Bangor Hydro customer? If so, save […]

Exclusive for Xcel Energy Customers. Join Today and Reduce Your Electricity Bill..

Join a community solar garden, today! As an Xcel Energy customer in Minnesota, you can join a community solar garden […]

Check Out What’s New

Stay up-to-date on community solar in your area.

Join Solar Donates $25,000

Join Solar Donates $25,000 To Good Shepherd We are very happy to announce our first Brighter Future Nonprofit recipient. As a thank

What is the NEB

Net Energy Billing (NEB) is a recent Maine state law. Under the law, energy customers may “offset their electricity bills

Energy-Saving Tips

The Energy and Inflation Relationship – Energy-Saving Tips Before being adjusted for inflation, the cost of electricity is at an